Give Every Year. Make a Difference Every Day.

The Annual Fund is a yearly campaign that supports the school’s operating budget. Your support and participation in the Annual Fund are vital for Prince Avenue Christian School to continue its mission.

Your once-a-year contribution helps to bridge the gap between tuition and the true cost of educating a student. Your tax-deductible gift to the Annual Fund keeps our tuition reasonable.

While we are excited about tomorrow’s needs, we cannot overlook today’s requirements. We first ask our Board of Trustees and faculty/staff to support the Annual Fund before we reach out to our current families and the community. Strong continued participation by all PACS parents, grandparents, faculty, and alumni will continue to be a critical step in gaining outside support from foundations and corporations. Every gift is important to us. Maximizing participation is our goal, and you can help with a gift of any size.

There are two easy ways to donate:

- Donate with a Pledge Form:

Click Here to Use a Fillable Pledge Form

Drop this form with your donation by the front office or mail to:

Prince Avenue Christian School

Office of Development

2201 Ruth Jackson Road

Bogart, Georgia 30622

All checks made payable to Prince Avenue Christian School.

PACS Annual Giving Campaigns:

PRINCE ON THE GREEN

Monday, September 18, 2023

Prince on the Green is a school-wide event hosted by the Development Office to kick off this year’s Annual Fund. This fun and carnival-like atmosphere will feature rides and a live DJ while Prince families gather on the lawn for family fun. Dinner will be available for purchase from the Chick-fil-A food truck, Maepole Healthy Comfort Food, and Baddies Burgers. This wonderful event promotes unity as a school and builds excitement for our fundraising efforts.

Your admission is your generous Annual Fund gift!

Invitations/Tickets will be coming home with students the week of September 11th. Families can donate by bringing their donation cards to the event or through our online donation page.

Don’t miss this exciting opportunity to enjoy gathering with other Prince families and to support our wonderful school!

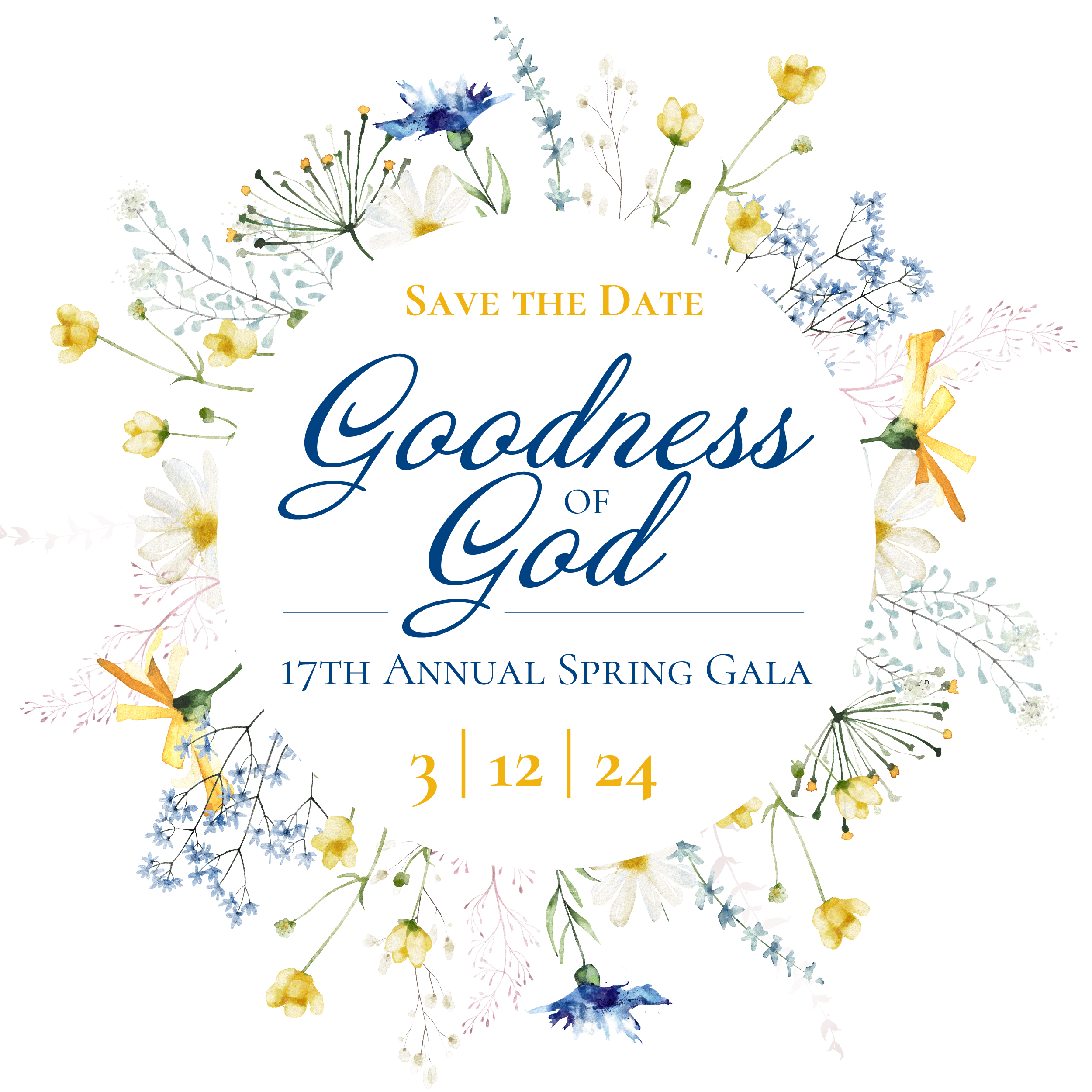

SPRING GALA

March 12, 2024 – SAVE THE DATE!

The Spring Gala is held to benefit Prince Avenue Christian School’s Annual Fund. This premier event provides an evening of excellence. Hundreds of guests are invited to enjoy music during the gala reception as they preview the annual silent auction. Auction items include unique art pieces, autographed sports memorabilia, special event tickets, fabulous trips, and a myriad of other exciting items. There is an elegant dinner which is followed by entertainment. We look forward with great anticipation to another exciting evening this year.

Guests can sponsor a table, purchase tickets separately, sponsor a teacher or guest, or donate to the Annual Fund. More information to come!

“It’s a Great Day to Be a Wolverine!”

Friday, May 3rd. 2024

The Wolverine Nation looks forward to the first Friday in May each year. This is a day set aside for the Wolverine community to bring their donations or fulfill their pledges to the Annual Fund. Imagine the impact on PACS if EVERY Wolverine made a gift EVERY year. Please join in our yearly tradition of giving generously and celebrating our great school. We invite our families, friends, and alumni to honor this Wolverine tradition.

Thank you for your generosity and continued dedication to Prince Avenue Christian School…it’s a Wolverine Tradition.

The deadline for receiving gifts for this year’s Annual Fund is June 30th.

Prince Avenue Christian School is a 501 (c)(3) non-profit institution.

Annual Fund Questions and Answers

The Annual Fund covers the gap between tuition and the actual cost of educating a student at Prince. Tuition covers about 98% of our expenses. The balance of our needed income comes from the Annual Fund, which provides the largest source of that income.

To cover the actual cost of educating a student would require a significant tuition increase. Such an increase would violate one of Prince Avenue Christian Schools core values; enrollment reflecting the racial, ethnic, and economic diversity within the body of Christ. Prince, like other private schools, generates its funding from a variety of sources. These include tuition, private grants, and fundraising from parents, alumni, and other community members. Tax-deductible donations to The Prince Avenue Christian School Annual Fund directly offset the current year’s operating budget, thus reducing each student’s annual tuition cost and encouraging a diverse student body.

Instead of asking students to become “salespersons” in their neighborhoods, PACS seeks voluntary gifts to our Annual Fund. Families support Prince because they believe in the school’s mission to be a Christ-centered, college preparatory school. The amount contributed through our annual fund is far greater than a school would ever raise selling products.

Based on enrollment and budget, the “gap” determines our Annual Fund goal after taking into account all of our sources of revenue. Enrollment and tuition revenue goals determine the potential operating costs for the new school year. Once school begins, actual enrollment and tuition revenue plus an estimate of other income establish the expected revenues. This budget process sets our goal for the annual fund to bridge the gap between expected revenues and budgeted operating costs.

Yes! Prince Avenue Christian School needs your participation. While the dollar goal is very important to meeting the annual budget, high participation rates (at any level) help Prince receive foundation grants for capital campaigns.

You can make your pledge or gift by mailing a check to our Development Office or by clicking here to access the giving page of our website.

We ask that Annual Fund gifts be undesignated. The Annual Fund is part of the school operating budget. However, there are times when exceptions can be made for unique opportunities.

Many employers have matching gift programs which will match your gift with company funds. The Prince Avenue Christian School Annual Fund qualifies for these matches as an educational institution. Check with your employer to see if your company participates in this program.

Yes. Prince Avenue Christian School is a 501(c)(3) not-for-profit organization.

PACS tax identification number is 01-0548823.

Gifts to a capital campaign allow us to build facilities, add programs, and develop the future of Prince. Capital campaign gifts are restricted to the specific purpose of the associated campaign. Annual Fund gifts by definition are unrestricted and fund the intentional gap between actual costs and tuition for each school year.

While the Prince Avenue Christian School Annual Fund accepts gifts throughout the year, your early gift or pledge helps the school with its budgeting and cash flow. We ask families to indicate their commitment by December 31. Payment on Annual Fund pledges is due by the end of the school year, June 30.

You will be contacted as often as necessary to secure your participation. In addition to the financial goal, there is also a goal of 100% parent participation. This helps us greatly when we make foundation grant requests. The best gift you can make is an early commitment and prompt payment.

No. The program provides a dollar-for-dollar tax credit to people or corporations who donate to scholarship funds earmarked for use by a specific private school. The Apogee Tax Credit Program restricts the use of these funds. Prince Avenue Christian School must use the money to offer tuition aid to a public school student seeking enrollment. Annual Fund gifts by definition are unrestricted.

Items such as activity fees, Fine Arts ads, and Booster Club dues do not meet IRS guidelines for 501(c)(3) tax deductibility due to the direct value received in return. Gifts to the Annual Fund are tax-deductible and they are used to minimize the fees and expenses associated with our students’ education.